38 Billion Pesos Withdrawn from AFORE Accounts Due to Unemployment

This article by Miguel Ángel Ensástigue originally appeared in the January 15, 2026 edition of El Sol de México.

AFOREs (retirement fund administrators) are private companies who manage pensions as individual accounts, extremely restrictive and profitable for finance capital: they were introduced in 1997 and based on the privatized pensions introduced in Chile by the fascist Pinochet. Recent figures reveal 51% of AFORE funds are used to buy Mexican state debt, which means that Mexican citizens are paying significant commissions for a private pension system where finance capital invests over half of their money in sovereign bonds. Many unions and workers organizations have called for the return of a public pension system, with the CNTE suggesting they would voluntarily move all of their pensions Mexico’s public bank and allow the funds to be used for social purposes and to build public infrastructure.

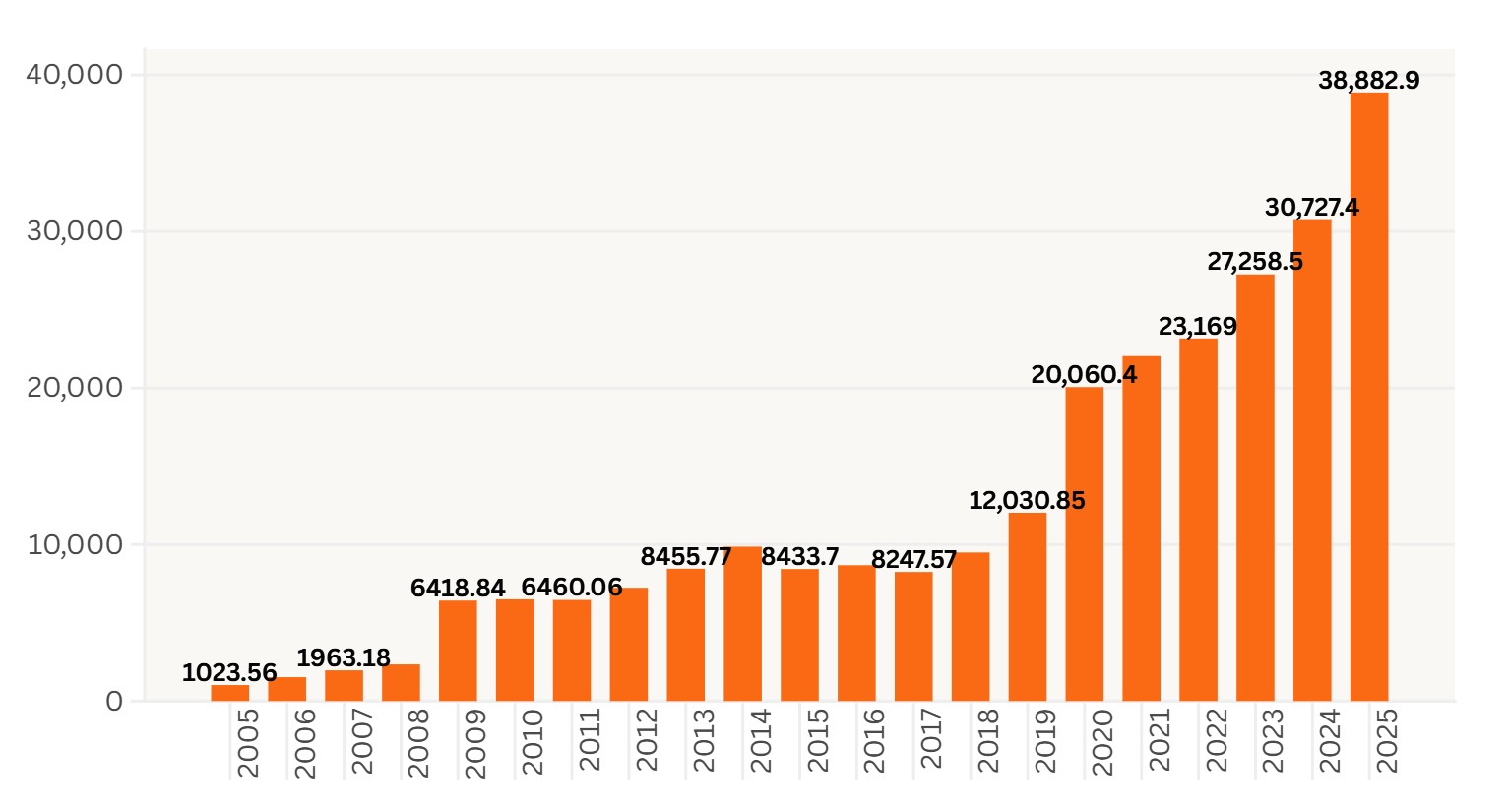

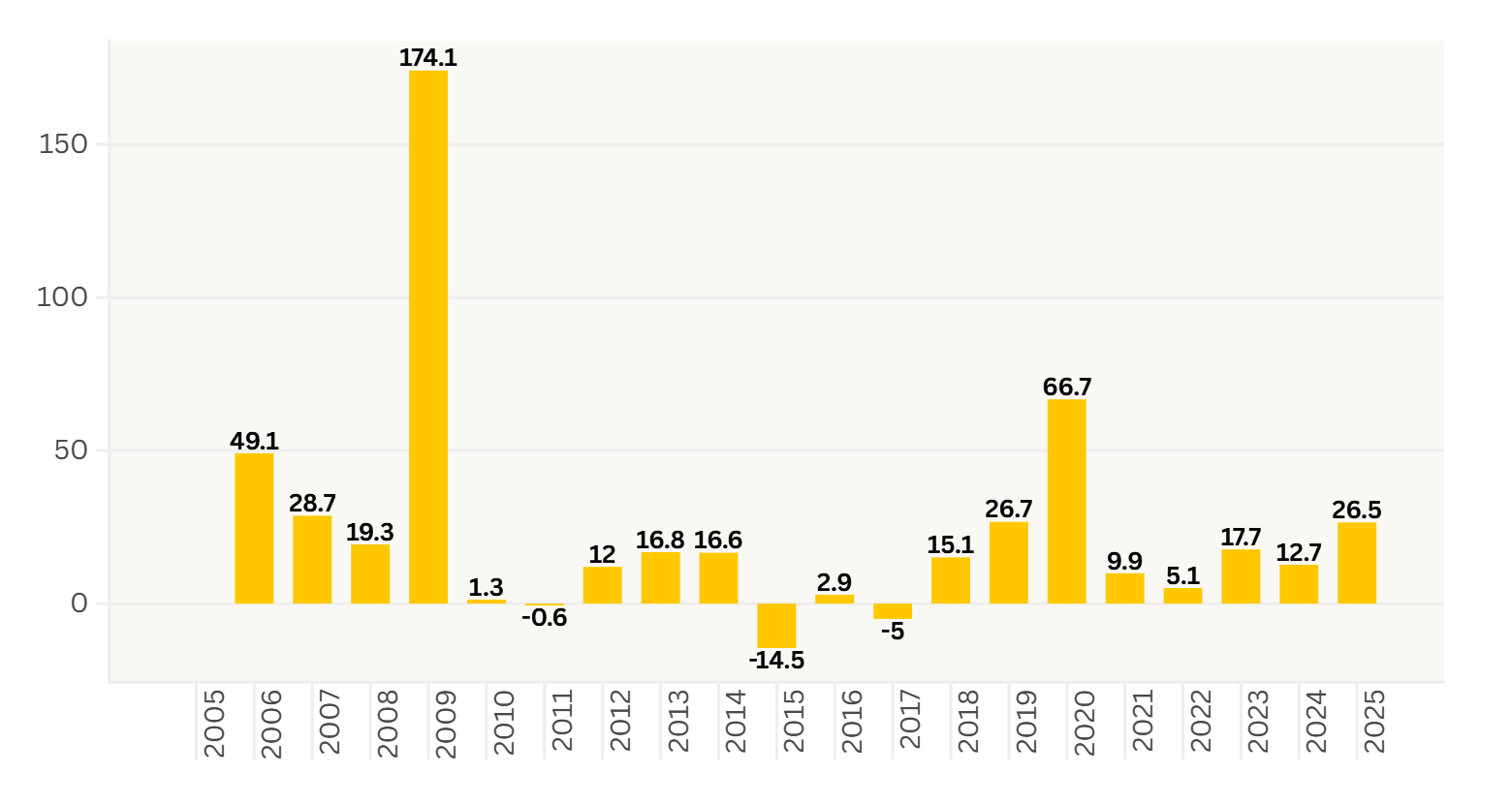

At the close of 2025, unemployment withdrawals from retirement savings accounts (AFOREs) broke records and climbed to 38 billion 882 million pesos , the highest level since 2005, the year up to which the National Commission of the Retirement Savings System (CONSAR) has records.

According to data from the regulator, around 1.94 million people requested this withdrawal from their retirement savings account, which represented an increase of 227,400 compared to 2024.

“This reflects that more people are turning to this type of support because they are losing their jobs ,” said Jacobo Rodríguez, economic analyst at ROGA Capital.

In an interview with El Sol de México, he explained that these withdrawals are also a reflection of how formal jobs are falling in the country.

The latest data from the IMSS shows that in December 2025 alone, 320,692 jobs were lost, representing a decrease of 1.4 percent compared to November.

Unemployment Withdrawls Increased 26.5% in 2025

Unemployment withdrawals are a right that all workers with a retirement savings account (Afore) have. However, making use of this right has immediate consequences, such as a decrease in the number of weeks of contributions or in the balance saved for retirement. To mitigate these impacts, people have the option of making voluntary contributions to their retirement savings account (Afore) that can range from 50 pesos to 100 pesos.

In this regard, José Miguel Hernández Durán, a lawyer specializing in labor law and managing partner of Laboral Pyme, warned that imposing administrative obstacles or discouraging the use of this right can worsen people’s economic vulnerability. He pointed out that, beyond unemployment, high job turnover also pushes workers to resort to these resources, since during transition periods they stop receiving income.

In that context, he added that there are campaigns that “demonize” retirement or make the process more difficult, ultimately affecting the worker directly by limiting a tool designed to cover basic needs.

The data from Consar shows that Afore Coppel led withdrawals during December with 914 million pesos, followed by Afore Azteca with 677 million, and XXI Banorte with 590.1 million pesos.

In the middle of last year, Consar warned that the misuse of this mechanism has been encouraged by private firms that, through misleading advertising, offer management services to temporarily inflate the worker’s salary before the IMSS and thus allow withdrawals greater than those that actually correspond.

According to estimates from the agency, 68.8 percent of unemployment benefits are withdrawn due to fees charged by these agencies, which operate between eight and ten thousand pesos per transaction. In addition to representing a significant expense for workers, the agency stated that this practice reduces their contribution history, lowers their future pension amount, and can even jeopardize their access to this benefit.

The Mexican Association of Retirement Fund Administrators (AMAFORE) stated that the increase in the amount of unemployment withdrawals is not something that worries them because it does not reflect the current situation of the labor market in the country.

Mari Nieves Lanzagorta, Vice President of Liaison at AMAFORE, highlighted that despite the increase in the amount, the number of withdrawals has remained constant in the last five years, even considering the spike observed in 2020 during the Covid-19 pandemic.

Who Owns the AFORES?

There are 10 AFORES, that as of 2025 manage more than 7.18 trillion pesos (401 Billion USD). The AFORES system, modeled on Chilean fascist dictator Pinochet’s privatization of pensions, have been criticized by international pension industry observers for lacking sufficient oversight. The Mexican government has cited the complexity of the system as a reason not to de-privatize it, which begs the question, if the pensions are too complex to return to the public, how can they be meaningfully overseen and regulated?

AFORES accounts are mandatory for every worker: they cannot withdraw from the system or manage the fund themselves or collectively with their union, such as with the Ontario Teachers’ Pension Plan, which manages over $188 billion USD).

1. AFORE Coppel – Coppel Group

2. AFORE Azteca – Grupo Salinas, owned by Ricardo Salinas Pliego, an ultra-right wing billionaire who is fighting in the courts to not pay the 35.450 billion pesos ($1.8 billion USD) in taxes he owes to the Mexican government.

3. Citibanamex Afore – Citigroup —in the process of being sold (USA)

4. Afore XXI-Banorte – Banorte

5. SURA – SURA Group (Colombia)

6. Profuturo – BAL Group (owners of the high-end department store El Palacio de Hierro)

7. Principal – Principal Financial Group (USA)

8. Invercap – Private investment fund

9. PensionISSSTE – The only public pension, limited to state workers

10. Inbursa – owned by Carlos Slim, one of the richest businessmen in the world, who advocates ending the public pension system and abolishing the retirement age in Mexico.

-

Workers Party Claims Sheinbaum Electoral Reform Will Eliminate Party System

The socialist party’s leader recalled the democratic spaces that the left managed to conquer with the 1977 & 1996 reforms, a “fruit of countless struggles, repressions, imprisonments, disappearances and even armed uprisings.”

-

Anti-FIFA Challenge: Football Defends the Territory

Mexico City residents are organizing Anti-World Cup Days to protest water theft and gentrification that have accompanied preparations for the World Cup, put on by the corrupt, international criminal consortium known as FIFA.

-

Tridonex Strike in Matamoros to Start March 6th

1,300 workers are expected to strike, demanding the company fulfill its obligation to pay workers in full. Tridonex is owned by First Brands, the US autoparts corporation accused of massive fraud.