Coke Adds Life?

This article by Alejandro Calvillo originally appeared in the October 18, 2025 edition of Sin Embargo. The views expressed in this article are the author’s own and do not necessarily reflect those of the Mexico Solidarity Project.

The Presidential initiative to increase the tax on soft drinks responds to scientific evidence and international recommendations to reduce consumption of this product, which is responsible for 230,000 new cases of diabetes and cardiovascular disease each year in Mexico. However, the tax is too weak to achieve the goal of reducing consumption of this product in a way that would have a significant impact; soft drink companies themselves have raised the price of the product well above these taxes on several occasions. The fact that the tax is so weak is the result of pressure from the country’s largest soft drink company. As is known, there is a clash between the interests of public health and those of the soft drink corporations, between the goal of reducing consumption of these products and those who seek to increase it. The international recommendation is that the tax should at least reach 20 percent of the market cost of soft drinks.

Not only has the World Health Organization recommended taxing this product as the most effective measure, but so have the World Bank and the Organization for Economic Cooperation and Development, because these financial institutions are well aware that there are no public resources to address the health risks caused by the consumption of these beverages. And the WHO is clear in warning that the alternative presented by soft drink companies, switching to beverages with non-caloric sweeteners, has no impact on reducing overweight, obesity, and diabetes, and that these compounds pose recognized risks and others that have not yet been evaluated.

As we explained, Mexico is among the countries with the highest consumption of sugary drinks worldwide, a consumption that is linked, we repeat, to more than 230,000 new cases of diabetes and cardiovascular disease each year. It is also worrying that this consumption begins at an early age and is currently projected to increase rapidly among the child population, where 9 out of 10 children regularly consume these products. It is estimated that one in two will develop diabetes with the current consumption of soft drinks and ultra-processed foods. In this context, increasing the tax on sugary drinks and sweeteners based on international recommendations should be considered a priority public health strategy. However, it must be sufficient.

It should be noted that Mexico already has a tax on sugary drinks, implemented in 2014. Initially, it was 1 peso per liter, equivalent at that time to 10 percent of the product’s value. The recently approved proposal to increase the IEPS (Income Tax on Sugars) from 1.64 to 3.08 pesos per liter is equivalent to just 13 percent of the final price. In other words, over the course of a decade, the tax would have increased by only 3 percentage points, going from the initial 10 percent to 13 percent, which is still far below the 20 percent recommended by international organizations to achieve a significant impact on reducing consumption.

The same thing happens with soft drinks with sweeteners as with vaping: the soft drink industry, like the tobacco industry, looks for other products to maintain its profits and foster addiction to its products from a very early age.

Although Mexico was an international pioneer in implementing a tax on sugary drinks in 2014—serving as a benchmark for dozens of countries—currently, of the more than 80 countries that have adopted this type of measure, our country is at the bottom, with one of the lowest tax levels.

On the other hand, despite recognizing the importance of including beverages with non-caloric sweeteners in the IEPS (Specialized Tax on the Use of Sweeteners), the fact that it has been set at 1.5 pesos per liter—a lower rate than the tax applied to beverages with added sugars—could encourage consumption of these products, despite growing scientific evidence pointing to potential health risks associated with their consumption. It’s a game of Russian roulette: how many sweeteners are banned in certain regions of the world? How many have been removed from the market? How many are warned about risks? The same thing happens with soft drinks with sweeteners as with vaping: the soft drink industry, like the tobacco industry, looks for other products to maintain its profits and foster addiction to its products from a very early age.

Of particular concern is that this measure will promote the replacement of sugary drinks with reformulated versions containing sweeteners or other undesirable ingredients, in a context in which the soft drink industry has announced its collaboration with authorities, opening the door to undue influence schemes within the government. This concern is heightened when considering this industry’s history of opposition to various public health policies that affect its economic interests, as has occurred in the cases of regulations in school settings, advertising directed at children, front-of-package warning labels, and, of course, the tax implemented in 2014.

Authorities must stand firm in the face of pressure, lobbying, and dirty campaigns from these corporations. They must prioritize health and avoid the narrative that they, too, are part of the solution, a strategy that ties the hands of public health policy, as has been pointed out by international organizations. Policy cannot be designed with those with conflicts of interest, as was done during the Peña Nieto administration; we know the results.

Without political will, without a radical prioritization of public health over corporate interests, we will not emerge from the epidemiological emergency we are experiencing due to obesity and diabetes, deeply linked to soft drink consumption. This situation seriously affects the population, especially children, and this should not be negotiable.

Finally, a note on the mockery Coca-Cola made in the presence of the Ministry of Health itself, mentioning that they are committed to not using children or minors in their advertising. This commitment is absurd; it is not permitted by law. The law goes much further, establishing that they cannot use elements appealing to children in their advertising, especially characters. They continue with their Christmas Caravans, with Santa Claus promoting their drinks and all the Christmas elements captured for their product’s advertising.

In conclusion, within the government and on the part of the Presidency, there was strong resistance to the soft drink companies’ attempt to withdraw the proposal to increase the IEPS (Special Tax on Social Security) on soft drinks, and to remove the IEPS (Special Tax on Non-Calorie Sweeteners) from beverages with non-caloric sweeteners, and this resistance must be acknowledged. However, it must be noted, based on scientific evidence, that a 13 percent tax is not sufficient; it does not meet the recommended minimum, will not have the desired effects, and will continue a negative trend in the epidemiological emergencies we are experiencing.

A few weeks ago, while the fiscal package was being presented in Mexico, a country of 1.4 billion people, India, with a much smaller problem of health risks from sugary drinks, established a 40 percent tax on these products. The soft drink industry there is growing at a rate of over six percent, and this is seen by health authorities as a threat to public health. In that vast country, a tax reform has been implemented aimed at addressing social inequalities. Essential products are exempt or taxed at five percent, most goods and services are taxed at 18 percent, and a new rate of 40 percent is reserved for items considered harmful or luxury, which includes sugary drinks.

If we continue negotiating with the industry, if we continue doing the same thing, we will undoubtedly not have different results.

And well, continue, dear readers and audiences of Sin Embargo, bearing witness to the bot and troll campaigns from anonymous accounts, very well funded—by whom?—against those of us who promote these policies based on evidence and international recommendations.

-

Workers Party Claims Sheinbaum Electoral Reform Will Eliminate Party System

The socialist party’s leader recalled the democratic spaces that the left managed to conquer with the 1977 & 1996 reforms, a “fruit of countless struggles, repressions, imprisonments, disappearances and even armed uprisings.”

-

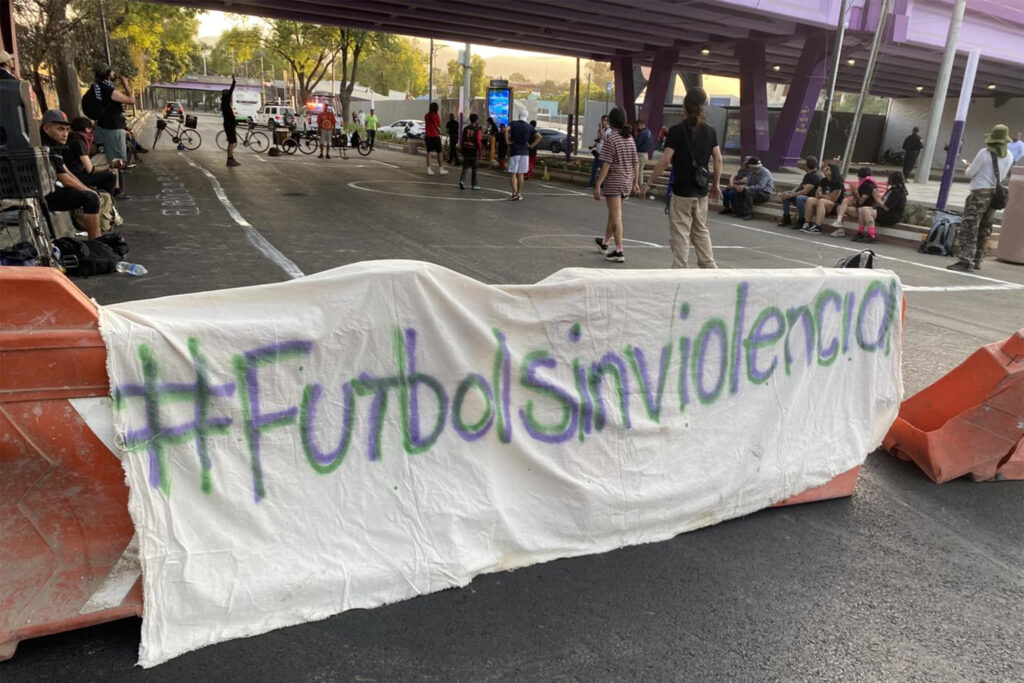

Anti-FIFA Challenge: Football Defends the Territory

Mexico City residents are organizing Anti-World Cup Days to protest water theft and gentrification that have accompanied preparations for the World Cup, put on by the corrupt, international criminal consortium known as FIFA.

-

Tridonex Strike in Matamoros to Start March 6th

1,300 workers are expected to strike, demanding the company fulfill its obligation to pay workers in full. Tridonex is owned by First Brands, the US autoparts corporation accused of massive fraud.