Foreign Investment Has Not Translated Into Greater Economic Growth

This article by Arturo Huerta González appeared in the August 26, 2025 edition of La Jornada de Oriente. The views expressed in this article are the author’s own and do not necessarily reflect those of the Mexico Solidarity Project.

On August 21, 2025, the country’s president celebrated the record that in the second quarter of 2025 foreign direct investment (FDI) totaled $34.265 billion, double the amount reported in 2017. She noted that “not even tariffs could stop the Mexican economy ” and that “the 4T model not only reduces poverty, but also generates investment.” The government announced that tax incentives for FDI have been established: 100% deduction of fixed assets, 25% in training and education expenses, and 25% in innovation and technological development.

The Ministry of Economy reported that 36% of this investment is in manufacturing, which has translated into greater foreign ownership of this sector. Foreign companies triangulate: they import inputs from China and Asia, take advantage of cheap labor in Mexico and the geographic advantage of being neighbors to the main market in the world, all of which increases their competitive advantage and their profits, but has not benefited the country. 26.7% of FDI is located in the financial sector, as a result of the fact that approximately 80% of the banking sector is controlled by foreign banks, which earn whatever they want and obtain higher profits than those they obtain in their country of origin and in other countries. Furthermore, it is a banking system that is dysfunctional for economic growth, due to the high interest rates and commissions it charges, which end up decapitalizing debtors, accentuating income and wealth inequality. The remainder of FDI is located in the construction and mining industries, where they achieve high profits that allow them to increase their investment and presence in the national economy, with the greater foreign domination1 of the economy. This is a consequence of the government’s lack of an economic policy favoring national private investment and the public sector and economic growth, therefore having fallen into a growing dependence on FDI, the country’s President celebrates the largest FDI in the country’s history.

Instead of the government announcing increased investment and public spending, as well as tax incentives for domestic private investment to boost economic growth and job creation and reduce our dependence on foreign investment, it chooses to continue promoting such investment and the foreign domination of the economy. It does not condition invesment’s entry into the country on boosting the national added value of what it produces and exports, nor on partnering with domestic companies and transferring technology to them to prevent them from being displaced by imports and transnational corporations. Instead, the government grants FDI greater tax incentives to increase its profits, without this translating into greater growth for the national economy, or greater formal employment and well-being for the population.

In the first half of 2025, the Treasury reported that public investment fell by 30%

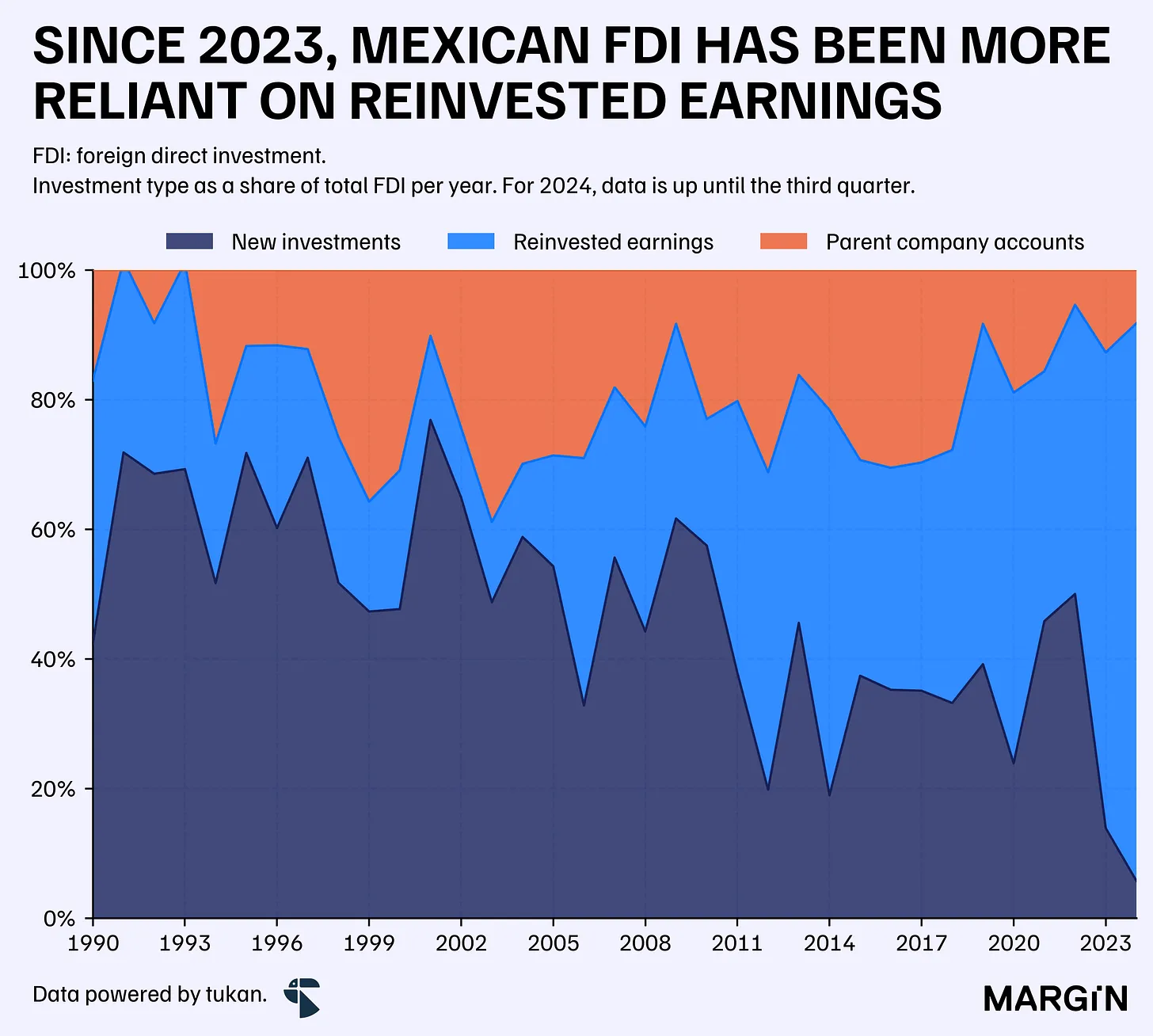

The Secretariat of Economy reported that of the total of 34,265 million dollars, 3,149 million dollars were new investments, which represented 9.2% of the total FDI and that 84.4% of the total was reinvestment of profits and 6.4% was between companies, that is, debts that were paid to transnational companies. This reflects the high profits that these companies obtain in the country, which allows them to increase their presence in the national economy, at the cost of reducing the participation of the national private sector and the government. Thus we observe the growing foreign domination of the manufacturing industry, the banking and financial sector, as well as mining, construction and large commercial and service stores. Hence their high profits, which allows them to invest where the national private and public sectors stop doing so, which increases their economic and political power, which translates into a greater interference in economic policy so that it responds to their interests, which leads the government to relegate the demands of its nationals, which has increased income inequality and poverty in the country, so what the president said is false, that “the 4T model reduces poverty and generates investment .” In the first half of 2025, the Treasury reported that public investment fell by 30%, in addition to cutting spending on education and health.

To reduce poverty, generating well-paid, formal employment is required, and this does not happen in the country. While the increase in the minimum wage is important, it benefits those who earn a minimum wage, but this increase is not applied to the rest of the workers, so low wages remain. In addition, 55% of the employed population is in the informal sector in Mexico: they do not have a guaranteed salary, nor do they have employment benefits, nor are they subject to retirement and vacations. And the social policy implemented by the government , although it benefits those population that did not receive any income, is carried out at the cost of reducing public investment and spending on education and health, essential for present and future growth and the well-being of the population, therefore social spending does not counteract the problems derived from the predominant neoliberal policies.

- Extranjerización, a Spanish term with no immediate English equivalent, but roughly translated as foreign domination or foreign ownership. ↩︎

Arturo Huerta González is Professor of the Graduate Program at the Faculty of Economics of UNAM since 1975, a columnist responsible for the Alternativa Económica column at La Jornada de Oriente, and the author of La crisis en Estados Unidos y México: 10 años después.

-

CNTE Announces 72 Hour National Strike & March to Mexico City’s Zócalo

The class-conscious teachers union will also make “courtesy visits” to the embassies of countries who committed atrocities against Iran, to show their rejection of US imperialism.

-

Yet Another Mexican Citizen Dies in ICE Custody

The unidentified victim is the 9th Mexican citizen to have been killed in ICE detention since the beginning of 2025; this time in Adelanto, California.

-

Let’s Talk About Migration: Trumpist Persection

Millions of women who have endured unspeakable violence on their migration journey are now being persecuted in the United States by an extremely xenophobic and misogynistic government, led by Donald Trump,